It started as a joke. A harmless prank meant to lighten the pressure of Wall Street’s relentless pace. But within twelve hours, it would become one of the most expensive mistakes in financial history—a cautionary tale that traders and investors would whisper about for years.

The Rise of “Emu” Draven

Elliot Draven wasn’t your typical Wall Street trader. At just 29, he had already become a legend. Colleagues called him “Emu,” a nickname from college when he’d sprint across the soccer field with his long strides and wild hair. The name stuck, and he wore it proudly—fast, fearless, unstoppable.

Draven Capital, the hedge fund he founded at 26, was built on risk, precision, and confidence. His secret? A proprietary AI trading system that could analyze thousands of data points per second and execute perfect trades in milliseconds.

By October 2025, the firm had crossed a milestone few ever reach: its 100 millionth trade. It was time to celebrate. And that’s where things went wrong.

A Celebration Too Wild for Wall Street

The office was electric that Friday night. Champagne, laughter, and the hum of success filled the air. Someone joked, “We should get a real emu for the party!”

At first, everyone laughed it off—until one intern made a few calls. By 7 p.m., a delivery truck pulled up. Out stepped an actual emu, tall, curious, and completely unfazed by the Manhattan skyline.

The bird strutted through the trading floor like it owned the place. Phones came out, pictures were taken, and for the first time in weeks, stress melted into laughter.

“It was perfect,” one employee later said. “Emu was our mascot. It felt like we were untouchable.”

As the night went on, the champagne ran out, the music faded, and one by one, the traders left. The bird, however, stayed behind.

And that’s when the unthinkable began.

The Night the Emu Took Over

The office lights dimmed as motion sensors powered down. Monitors glowed faintly, servers hummed, and at the center of it all sat Draven’s workstation—a sleek glass desk with a custom keyboard connected to the firm’s AI trading system.

At 2:43 a.m., security footage captured the emu pacing near Draven’s desk. It cocked its head, studying the reflection in the monitor. Then, with one curious peck, it struck the space bar.

What happened next is the kind of event risk managers have nightmares about.

That simple peck triggered an automated macro—one designed to execute Draven’s “100M trade celebration” first thing in the morning. But because the command was initiated without confirmation, the system interpreted it as a signal to begin its contingency sell-off protocol.

In less than 30 seconds, Draven Capital’s portfolio—nearly $300 million in global positions—began liquidating itself.

The Morning After

By the time Elliot Draven arrived at 6:45 a.m., it was already too late.

The markets had opened, and the firm’s system had dumped nearly every major holding—tech stocks, commodities, futures—into open market chaos. Billions of automated trades rippled outward, briefly shaking indexes across Europe and Asia.

The moment he saw the numbers flashing red across his monitors, Draven froze. His empire, his genius algorithm, his years of precision—gone, undone by a single rogue peck.

Security video told the story no human could believe. There it was: an emu standing over his desk, tapping at keys, triggering commands.

Wall Street had seen crashes before, but never one caused by a bird.

The Fallout

Within hours, news of the “Emu Crash” spread. Financial blogs ran wild with headlines: “Feathered Frenzy Wipes Out Hedge Fund” and “Bird Beats Algorithm.”

Major investors demanded explanations. The SEC launched an inquiry into how such a simple action could override a billion-dollar system.

“This isn’t just absurd—it’s alarming,” said Marcus Chen, a financial technology consultant. “If one unverified keystroke can trigger a liquidation protocol, then we’re not just looking at a bird problem. We’re looking at a human design failure.”

Inside Draven Capital, panic turned to disbelief. Some employees cried. Others laughed—because what else could they do?

“It was supposed to be funny,” one former analyst admitted. “We just wanted to celebrate. No one thought it would end an entire company.”

What Really Went Wrong

Experts who later analyzed the system uncovered a chilling truth: the algorithm wasn’t faulty—it was too efficient.

Draven had designed it to respond instantly to market triggers. But in his pursuit of perfection, he had bypassed one simple thing: a physical confirmation layer.

The emu’s peck was read as an authenticated command, validated by Draven’s pre-set credentials left active on his workstation. The system did exactly what it was built to do—obey.

It wasn’t the bird that broke Wall Street. It was human overconfidence.

The Man Behind the Meltdown

Elliot Draven hasn’t spoken publicly since that day. Friends say he left the city, taking a small apartment upstate near the Hudson River. He spends most mornings walking trails, feeding birds—the irony not lost on anyone who knows him.

“He used to say his trading was like flying,” a colleague shared. “Now he actually watches birds instead.”

Draven’s fall from grace became a parable taught in business schools: “The Emu Effect”—a reminder that even the most sophisticated systems can crumble under the simplest oversight.

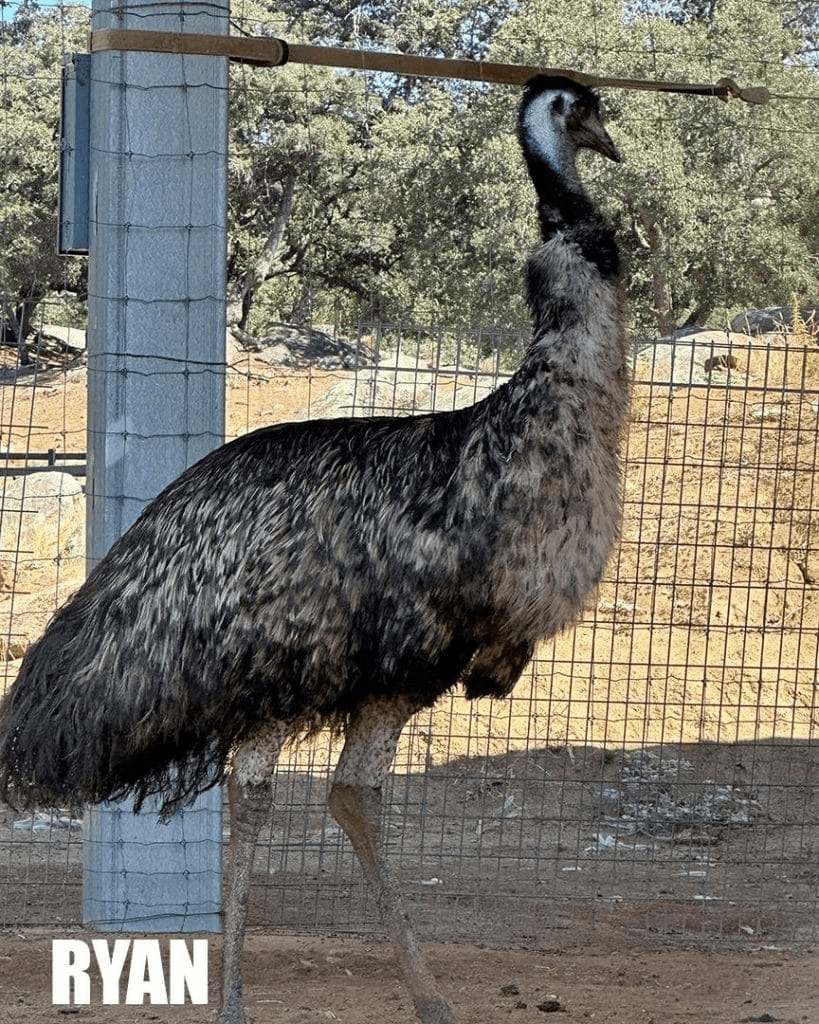

The Bird That Didn’t Know

The emu was unharmed and later returned to a farm in New Jersey. Workers there nicknamed it “Trader.” It still wanders freely, blissfully unaware that it once caused a Wall Street meltdown.

Some journalists tried to visit, but the owner politely declined interviews. “She’s just a bird,” he said. “She doesn’t know she broke the stock market.”

Lessons from the Emu Incident

Financial advisors, cybersecurity experts, and behavioral economists have dissected the event for years. Their conclusions point to one undeniable truth: technology can amplify human error faster than we can react.

Here are three lessons the Emu Incident left behind:

- Never automate without fail-safes. Even the best AI needs human checkpoints.

- Don’t underestimate human behavior. Overconfidence blinds judgment faster than failure ever could.

- Culture matters. When playfulness meets high-stakes systems, chaos isn’t a question—it’s a countdown.

And yet, beyond the corporate lessons lies something deeper—something almost poetic.

A Feathered Reminder

In the end, “The Bird That Broke Wall Street” isn’t just a story about finance. It’s a story about the fragile line between control and chaos. About how success can make us reckless. About how one living creature, acting by instinct, revealed the illusion of human mastery.

Because that’s the quiet truth no hedge fund wants to admit: beneath all the algorithms, formulas, and strategies, Wall Street still runs on faith—faith that the system will obey.

But on that October morning, it didn’t.

It obeyed a bird.

And in doing so, it reminded the world that even the sharpest minds can be undone by a single forgotten detail—and a curious peck on a keyboard.

So the next time someone tells you that artificial intelligence, automation, or trading algorithms are infallible, remember this: somewhere in a quiet New Jersey farm, an emu once outsmarted them all.

And that’s no joke—it’s the most expensive lesson in Wall Street history.